Cement, a crucial building material, serves as the foundation for various construction and infrastructure projects worldwide. From residential buildings to commercial complexes and infrastructure projects like roads, bridges, and dams, cement is indispensable. However, cement prices have shown considerable fluctuations in recent years due to numerous factors, including raw material costs, energy prices, transportation expenses, and environmental regulations. For construction companies, contractors, and stakeholders in real estate, understanding cement price trend is essential for effective cost management, planning, and project execution. In this article, we’ll explore the factors influencing cement price trends, current market conditions, regional price differences, future price projections, and strategies for managing costs in light of these trends.

1. Overview of Cement Production

Cement production is an energy-intensive process, involving heating limestone and clay at high temperatures to create clinker, the primary ingredient in cement. Clinker is then ground with gypsum to produce the final cement product. Raw materials such as limestone, clay, shale, and silica, as well as fuels like coal and natural gas, are essential for cement manufacturing. Due to the energy demands of cement production and the costs of raw materials, the industry is significantly impacted by fluctuations in these inputs. Cement prices are primarily determined by supply and demand dynamics, production costs, and external economic and regulatory factors. Enquire For Regular Prices: https://www.procurementresource.com/resource-center/cement-price-trends/pricerequest2. Key Factors Influencing Cement Price Trends

Several factors contribute to the changing prices of cement, including:A. Raw Material Costs

- Limestone Prices: As the primary ingredient in cement, the cost of limestone is a key driver of cement prices. Availability and mining regulations can impact limestone prices, especially in regions where resources are limited.

- Gypsum and Other Additives: The cost of additives, such as gypsum, which is mixed with clinker to produce cement, can also affect cement prices. The availability and transportation of these additives play a role in determining costs.

- Transportation Costs: Raw materials are often transported over long distances, which adds to the production costs. Rising fuel prices, transportation disruptions, and logistics issues can all contribute to price volatility in the cement industry.

B. Energy Costs

Energy consumption is a major component of cement production costs, given the high temperatures required in the kiln process.- Electricity Prices: Cement production requires a significant amount of electricity, especially during grinding and milling processes. Fluctuations in electricity costs directly impact the final cost of cement.

- Fuel Prices: Kilns in cement plants are typically powered by coal, natural gas, or other fossil fuels. Increases in fuel prices lead to higher production costs, driving up cement prices. Many producers have begun exploring alternative energy sources to reduce dependence on fossil fuels, though these require significant investment.

C. Supply and Demand Dynamics

Cement demand is closely tied to the construction industry, which experiences fluctuations based on economic conditions, government infrastructure spending, and seasonal factors. When demand for cement increases, such as during infrastructure booms, prices tend to rise. Conversely, during economic downturns, construction slows, reducing demand and often lowering prices.D. Environmental Regulations

The cement industry is a major source of carbon dioxide emissions, and many governments have introduced regulations aimed at reducing emissions. Compliance with these environmental standards requires investment in cleaner technology, emissions controls, and energy efficiency improvements, all of which increase production costs. Carbon pricing schemes in some regions have also added financial pressure on cement producers, contributing to higher prices.E. Technological Advancements and Efficiency Improvements

While investments in advanced technology can help reduce energy consumption and improve production efficiency, they often come with high initial costs. Some cement producers are adopting alternative fuel sources and innovations in energy-efficient technologies. Over time, these improvements can help stabilize prices, though the upfront investment can initially lead to cost increases.3. Current Cement Price Trends

In recent years, cement prices have experienced notable fluctuations. Some key trends observed include:- Post-Pandemic Demand Surge: Following the initial disruptions caused by the COVID-19 pandemic, the construction industry rebounded, with government spending on infrastructure projects increasing demand for cement. This surge in demand led to higher cement prices globally.

- Raw Material and Energy Price Volatility: Rising costs of limestone, gypsum, and other raw materials, as well as energy price increases, have driven cement prices upward. In particular, the cost of coal and natural gas, critical fuels in cement production, has risen significantly in recent years.

- Supply Chain Disruptions: Ongoing supply chain issues, especially in terms of fuel availability and transportation logistics, have contributed to price volatility in the cement market. Delays and higher costs in raw material shipments have added to the challenges.

- Inflationary Pressures: Global inflation, driven by various factors such as energy costs and labor shortages, has put additional upward pressure on cement prices as producers pass these costs to end users.

Regional Price Trends

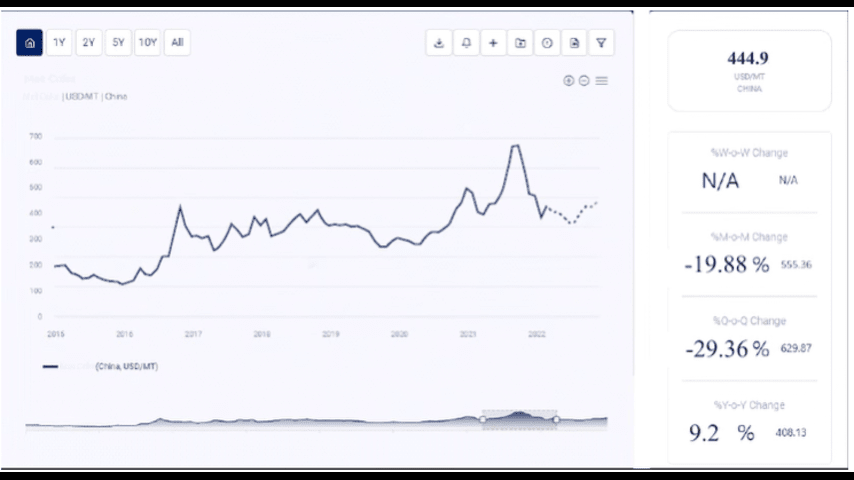

- Asia-Pacific: In Asia-Pacific, China and India are major cement producers and consumers. Prices in these regions have been influenced by government policies, demand from large-scale infrastructure projects, and fluctuating raw material costs.

- North America: Cement prices in North America have been impacted by increased demand for infrastructure and housing projects, alongside higher fuel prices and logistics challenges.

- Europe: European cement prices have risen due to environmental regulations, energy price volatility, and supply chain constraints. The region’s shift toward sustainable practices and alternative fuel sources has also influenced costs.

4. Future Cement Price Projections

The outlook for cement prices depends on several factors:- Sustained Infrastructure Investment: As governments globally continue to invest in infrastructure, the demand for cement is expected to remain robust, potentially sustaining higher prices in the near term.

- Energy Transition in Cement Production: As more cement producers shift toward alternative energy sources and sustainable practices, initial costs may rise due to investment in new technology. Over time, however, these changes could lead to more stable or potentially lower production costs.

- Environmental Regulations and Carbon Pricing: As more regions implement carbon pricing and strict emission controls, production costs may increase further, likely driving up cement prices, especially in environmentally regulated markets.

- Economic Conditions: Cement demand is sensitive to economic conditions, with recessions or slowdowns potentially reducing demand. Economic stability could lead to balanced supply and demand, while a slowdown may decrease demand, easing price pressure.

5. Strategies for Managing Cement Price Volatility

For construction companies, contractors, and developers, managing cement price volatility is essential for budgeting and cost control. Some effective strategies include:- Long-Term Contracts and Hedging: Engaging in long-term contracts with cement suppliers can help lock in prices and minimize exposure to market volatility. Companies can also explore hedging strategies for added protection.

- Sourcing from Multiple Suppliers: Building relationships with several suppliers across different regions can reduce dependence on a single source and mitigate the impact of regional price fluctuations.

- Efficient Design and Material Optimization: Optimizing the use of cement in construction designs and adopting alternative building materials where feasible can reduce dependency on cement and overall project costs.

- Inventory Management: When prices are expected to rise, increasing inventory levels can help buffer against future price surges. However, effective inventory management is necessary to avoid overstocking and associated storage costs.

- Monitoring Market Trends: Staying informed about market dynamics, such as changes in raw material availability, energy prices, and regulatory shifts, helps companies make proactive decisions and anticipate cost fluctuations.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: sales@procurementresource.com

Toll-Free Numbers:

- USA & Canada: +1 307 363 1045

- UK: +44 7537171117

- Asia-Pacific (APAC): +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA